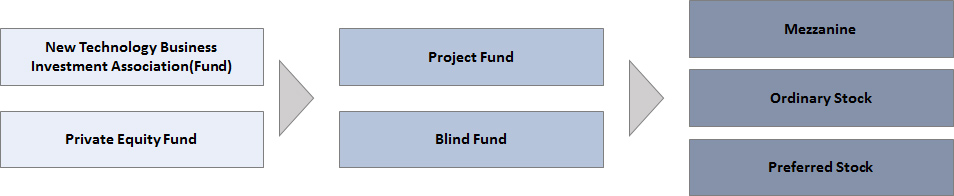

| Definition | ㆍ “New Technology Project Financing Company” means an institution registered with the Financial Services Commission for new technology business and that does not concurrently conduct credit card business, facility leasing business, installment financing business or other financing business prescribed by Presidential Decree. ㆍ “New Technology Business Investment Association(fund)” means associations established by any new technology project financing company through joint investment with a person other than a new technology project financing company or operated and managed by a new technology project financing company, seeking to invest to new tech business entities. ㆍ “New Technology Business Entity(targets)” means a SME engaging in research, development, improvement and commercialization related to new technology business excluding enterprises engaging in insurance activities, real estate activities and other activities that are barely related to new technology business. |

|---|---|

| Scope of Application | ㆍ Investment in new technology business entities

ㆍ Providing loans to new technology business entities ㆍ Providing managerial and technical assistance to new technology business entities ㆍ Establishing new technology business investment association ㆍ Managing or operating the funds of new technology business investment association(fund) |

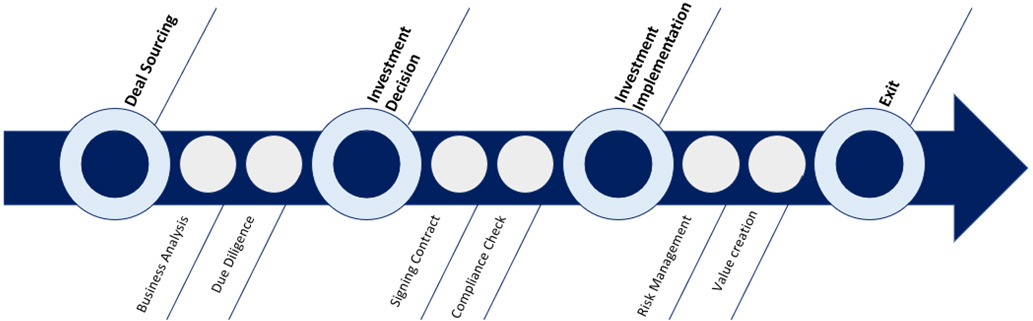

| Deal Sourcing | ㆍ Deal sourcing through fully utilizing deep know-hows and professional skills in relation with FAS and cross-border deals and global networks owned by SU&Partners ㆍ Deal sourcing through professional networks such as KRX(Korea Exchange) M&A intermediation platform ㆍ Deal sourcing through private networks(M&A forums and sessions led by CEO, etc) |

|---|---|

| Investment Decision | ㆍ Capable of making precise and prompt investment decisions on the basis of various investment and M&A experiences along with pre due diligence conducted by our dedicated professionals including certified public accountants |

| Investment Implementation | ㆍ Effectively implementing investment strategies with precise and prompt investment decisions in line with punctuality, which would maximize a target’s growth and our clients’ interests |

| Exit | ㆍ Actively identifying company-specific factors by having frequent communication with management and releasing a regular report to our LPs ㆍ Effectively increasing a firm value of the targets by risk management and growth strategies while maximizing returns with establishing best exit strategies, considering the related market trends |

| Listed Company | ㆍ Co-buy out investment with SI for acquiring undervalued listed companies ㆍ Bridge loan investment ㆍ Mezzanine investment on blue-chip companies |

|---|---|

| Privately- held Company | ㆍ Co-buy out investment with SI for acquiring undervalued listed companies ㆍ Bridge loan investment (typically up to a year) ㆍ Mezzanine investment on blue-chip companies ㆍ Pre-IPO investment ㆍ Equity investment on companies preparing for SPAC and back door listing ㆍ VC investment on companies with unique innovation |

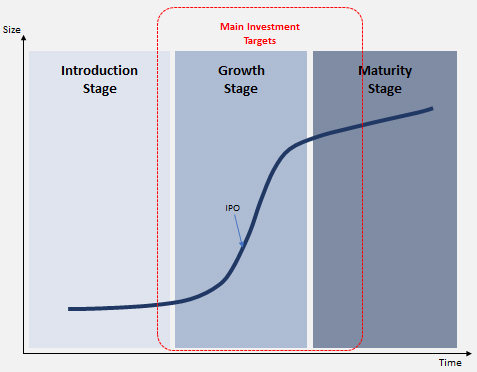

| 1 | ㆍ Buy-out Investment Identify undervalued blue-chip companies originally equipped with competitive advantages and make a buy-out investment for them to maximize their firm value by using our global networks |

| 2 | ㆍ Growth Capital Investment Identify companies with disruptive innovation other than companies that grow with lower cost strategies and make a growth capital investment for them to effectively grow with our deep insight and understanding across various industries |

| 3 | ㆍ Overseas Investment or JV Investment Identify companies in early maturity stage stuck in a stagnated market and help them grow further with an overseas investment or JV investment via our global networks |

| Pre-Management | Monitoring | Post Management |

| ㆍ Risk management + Regulation in place ㆍ Pre-examine the potential risk factors and prepare preventive actions | ㆍ Constant and strict monitoring against market risk ㆍ Maintain surveillance system for inspecting market volatility | ㆍ Creating procedure for risk exemption ㆍ Organize the risk management committee ㆍ Inspect compliance of regulations and apply to performance evaluation |